It would seem that crises have become a normal part of our lives nowadays. While the pandemic is gradually losing its grip, the war in Ukraine and the energy crisis have created yet another period of uncertainty. Inflation rates have been going up as well. Fears are growing that this may all lead to a global recession. Family-run companies are proving to be a stabilising force in this challenging environment. Indeed, studies have confirmed that family-owned businesses continue to add value and create jobs in difficult times as well.

The general opinion is that family-run firms, such as REMONDIS, not only play an important role in the economy but have always proven to be a beacon of stability and dependability as well. This can be put down to the importance that they place on corporate responsibility and their cross-generational approach. Their wish to ensure their business has a strong, long-term future means that they are prepared to make significant investments – even when the economy is doing less well. At the same time, family firms are particularly agile. Thanks to their flat hierarchies and short coordination processes, they can normally make decisions quickly – enabling them to be flexible and to react to changes in a timely manner.

In many cases, you simply need to look at how old family firms are to see just how resilient these special features make them: on average, the largest family-owned companies have been on the market for almost a century. They have spent decades developing their business, strengthening and growing their market position and delivering a steadfast performance through a whole variety of crises. And a study published by the Foundation for Family Businesses [Stiftung Familienunternehmen] has shown that was also the case during the Covid crisis. To be able to put together this extensive study, data was gathered from the 500 largest family businesses based in Germany (measured according to the size of their workforce and turnover) and covered the period between 2011 and 2020. This meant that it also included the first year of the pandemic – the year that had the biggest impact on the economy.

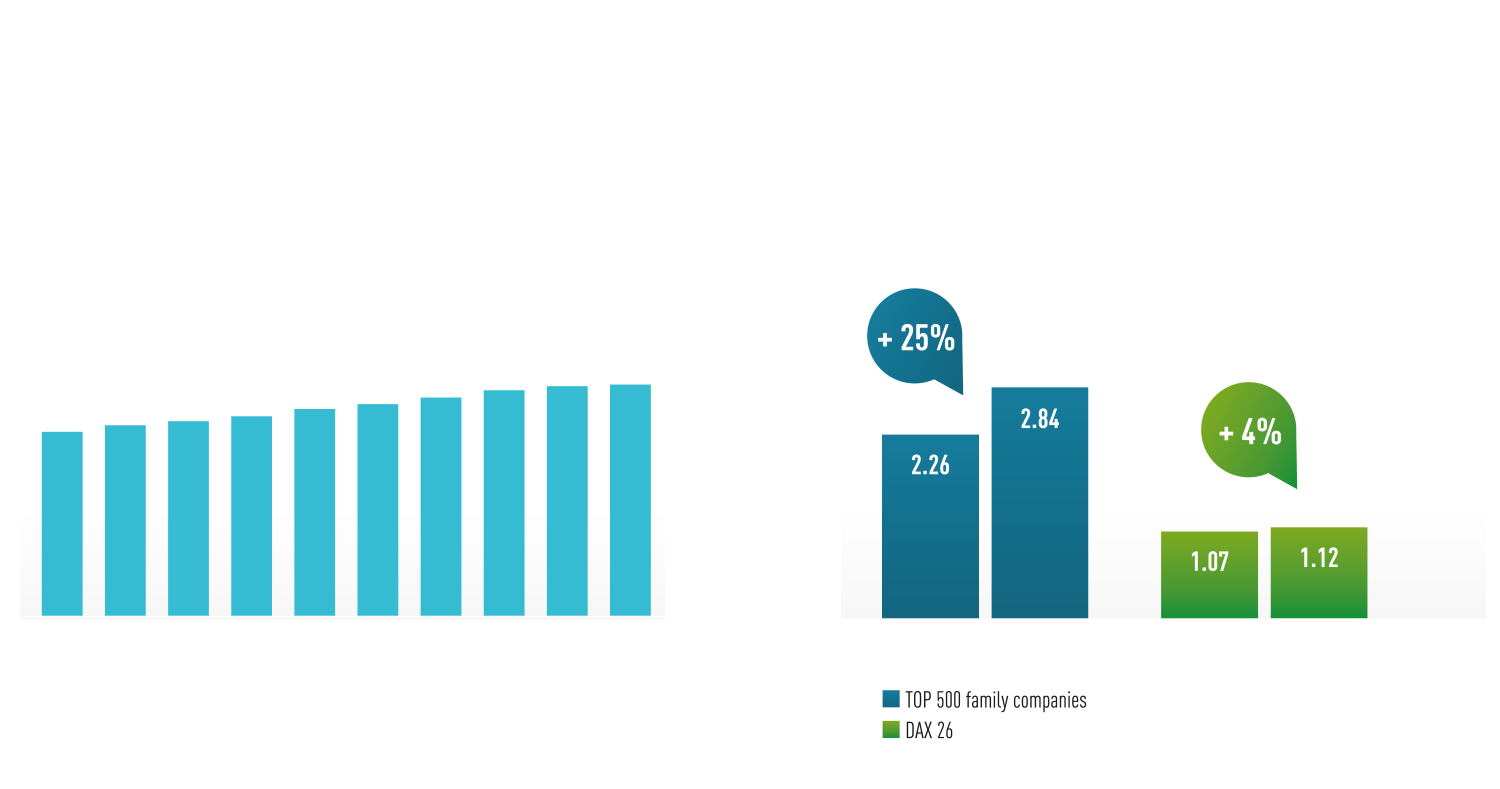

More jobs created than by DAX firms – large family-run companies grew their German workforces by 25% between 2011 and 2020. The number of people employed by the DAX-listed firms increased by 4%.

A creator of jobs & a reliable employer: Family businesses provide job security

The labour market in Germany looked dismal in 2020, year one of the pandemic. The number of unemployed (on average for the year) rose by 429,000; never before had so many employees been put on furlough. The situation, though, was quite different at the family-run firms. While the overall employment rate in Germany dropped again for the first time in ten years, family companies continued to grow their workforces – despite the Covid crisis and despite the economic

downturn.

According to the results of the study, the number of people employed in Germany by the TOP 500 family-run businesses increased from 2.82 million to 2.84 million in 2020. Worldwide, companies owned by families grew their workforces from 6 million to 6.04 million employees. Both developments confirm a trend that the Foundation for Family Businesses had already observed in previous studies: family-owned firms do not cut their workforces when they find themselves facing difficult economic conditions, not even when these impact negatively on their revenues.

To be able to better evaluate workforce development at family businesses, the study compared the data from the Top 500 firms with the same key figures from DAX firms, i.e. the crème de la crème of Germany’s publicly listed companies. This information was based on the DAX 30 index that still existed in 2020 and that, at the time, also included four family-run companies. The four family businesses listed on the DAX were included in the list of family-run companies for this particular study. The results of this comparison confirmed that family-owned firms created new jobs during the first year of the pandemic while the DAX-listed companies cut their workforces. According to the study, this was an effect that could also be seen during the 2008/2009 financial crisis.

A look at the whole of the period covered by the study reveals that the largest German family-run businesses created over 1½ million new jobs around the world between 2011 and 2020; in comparison, the DAX firms grew their workforces by around just 390,000. Digging into the details, the companies owned by families added more than 585,000 new jobs in Germany itself while the DAX firms created a good 48,000 across the country. What’s more, looking at their turnovers, the family businesses performed better during this decade as well. On average, they grew by 3.77%. During the same period, the DAX companies increased by an average 1.69%.

A strong financial base – in 2020, the equity ratio of the TOP 500 family businesses lay at around 15 percentage points above the general average.

“Simply looking at the current price and raw material crises and the risks they pose to the economy, it should be very clear to everyone in Germany that family enterprises are an anchor of stability in Germany and make a significant contribution to our prosperity. The study shows that family-run businesses have been able to cope better with crises and keep their workforces together even in turbulent times – and especially in Germany.”

Professor Rainer Kirchdörfer, Chair of the Foundation for Family Businesses

Family businesses are an important economic pillar

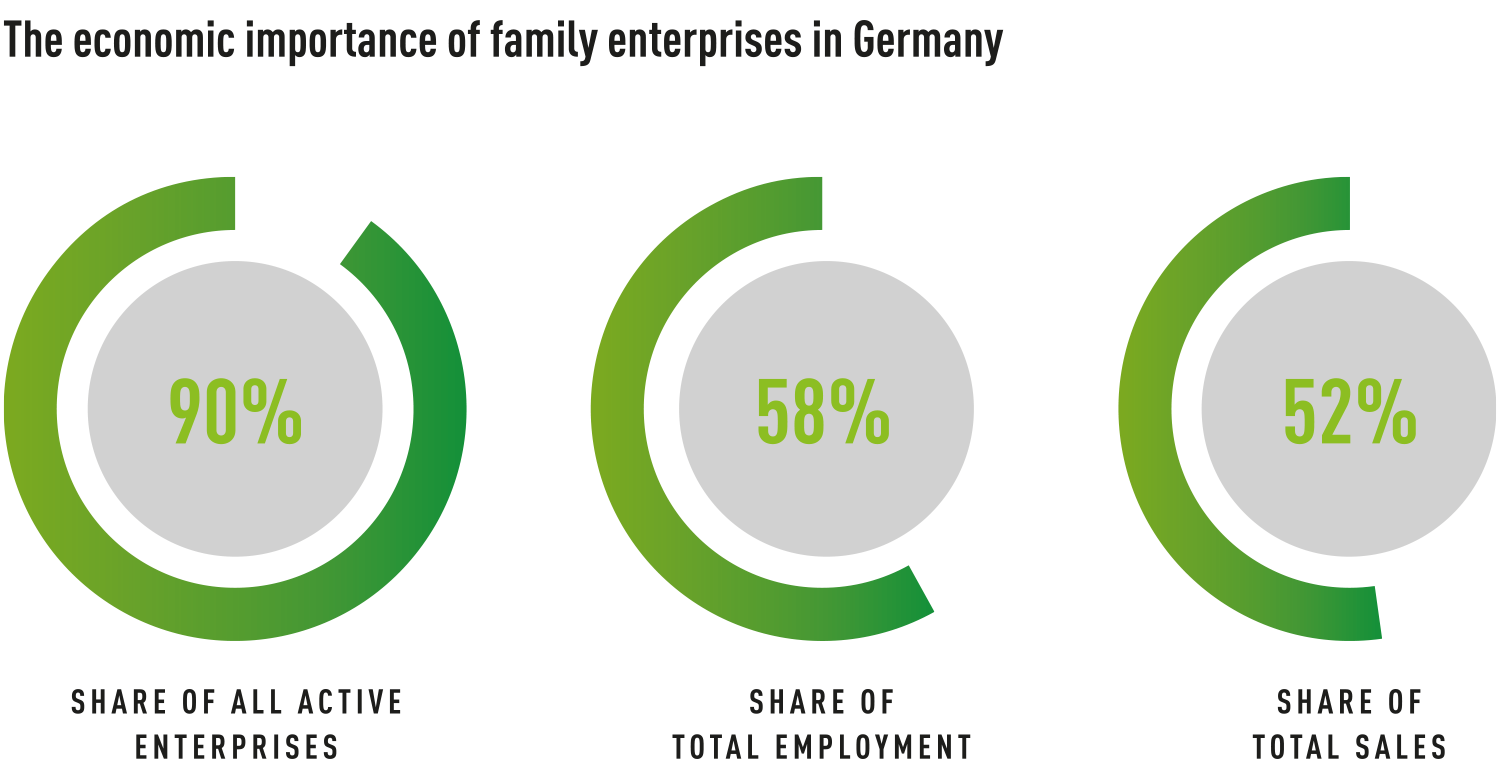

Firms owned by families, though, not only stand out in times of crises. They also play a significant role in the economy as a whole, especially in Germany. Around 90% of all German firms are family-run enterprises. More than 200 of them generate a turnover exceeding one billion euros. And almost 60% of all jobs in Germany are provided by family-run companies. Family enterprises have the edge on the international stage as well. According to the EY 2023 Family Business Index, the Top 500 family-owned firms around the globe increased their revenue by an average 14%, which meant that they grew faster than the global economy despite the many crises. Added together, the revenues of the largest international family enterprises lie at over 8 trillion US dollars. Were the world’s largest family-owned firms a national economy in their own right, then they would be the third largest in the world after the USA and China.

Source: ifm (Mannheim institute researching medium-sized businesses); own calculations

Looking ahead with optimism: family enterprises have their eyes firmly on the future

Family-run businesses also managed to master the second year of the pandemic relatively well. This has been confirmed by a study published by Ernst & Young (EY), a company offering accounting and advisory services, which surveyed German family enterprises with a turnover of over 10 million euros. According to their findings, 56% of family-run companies were satisfied with their situation at the end of 2021; this figure lay at just 49% for medium-sized firms with no fam-ily management. Asked about their growth strategies at that time, 33% of family companies said they were intending to increase their investments and 32% their workforce. Family enterprises were more optimistic in both these areas than other comparable businesses.

A success on the international stage as well – 78 of the world’s 500 largest family enterprises are based in Germany.

Another reason why family-owned firms are able to better weather challenging times – besides the strengths drawn from their longevity – is certainly their good capital resources. According to the Foundation for Family Businesses, the equity ratio of family enterprises lay, on average, between 41% and 45% from 2011 to 2020. By way of comparison: the average ratio of all companies lay at 28.5% in 2020. Having a high equity ratio, however, is a clear factor for creating financial stability and provides businesses with greater independence to implement and realise their strategies.

Family – a key to success

An interview with Norbert Rethmann, Honorary Chairman of the Supervisory Board of the RETHMANN Group

One thing is clear right away when Norbert Rethmann enters a room: age is not an issue. Practically no one else, apart from the company’s current management team, knows more about the situation and the future prospects of the company – a company founded by his father Josef in 1934 and taken over by him at the beginning of the 60s. He handed over the management of the group’s companies, REMONDIS, SARIA and Rhenus, to his four sons, the third generation of entrepreneurs, a while ago. And the fourth generation is already waiting in the wings. Despite doing this, though, he still remains fully committed to the business and is there to provide advice to today’s decision-makers. Norbert Rethmann sees his regular visits to the branches and finding time to talk to the drivers, loaders and other operatives working there as being a natural part of the company’s culture. We met up with him to talk about the secret behind his success.

“In contrast, people running their own family firm work in the business for the whole of their life and, ideally, hand over the baton to the next generation.”

RE:VIEWS: Mr Rethmann, the Handelsblatt newspaper and other media published an analysis at the beginning of 2023 that clearly showed that German family-run enterprises are more stable and more sustainable than the well-known DAX companies. They even maintained and grew their workforces during the pandemic. How would you explain this phenomenon?

Norbert Rethmann: I’d say that this can primarily be put down to the long-term planning of family firms as such planning is traditionally cross-generational. The boards of publicly listed companies might only be thinking up to the next press conference about their annual results and tend to focus on the medium term. Their commitment and, as a consequence, their ties to the business will eventually come to an end at some time or other. In contrast, people running their own family firm work in the business for the whole of their life and, ideally, hand over the baton to the next generation.

RE:VIEWS: No one, though, is born into this world as a successful company manager. What do you think – is there such a thing as an entrepreneurial gene?

Norbert Rethmann: That would be good, but success has nothing to do with genetics. For the most part, it can be put down to hard work, humility and the ability to pick up on emerging opportunities as well as the courage to take risks again and again. And steadfastness, of course. Today, we tend to call this sustainability. Sustainability must permeate through each and every part of a company and must be a creed that every employee follows. We work together, are committed long term to the company’s goals, are convinced of their significance and know that we will all benefit when they are achieved. To do this, you need a great deal of passion and good people. You can’t achieve anything on your own.

RE:VIEWS: Within just a few decades, you succeeded in turning your father’s forwarding business – a small firm with just a few vehicles and around 20 employees when you took over the reins – into a group of companies that now stretches across almost all continents. The various companies offer a whole range of products and services – from the recovery of raw materials through recycling, energy generation, water management, public sector and industrial services, to global logistics and the transformation of biogenic materials into energy, animal feed and even medicines, all the way through to public transport. How did you manage to do that?

Norbert Rethmann: Mainly by not taking out the profits, something that would never happen over the long term in the large corporations. We began reinvesting the profits into the business right from the start and this enabled us to grow the company. My sons, who manage the group’s companies today, are very strict about sticking to this tradition. The result is that the three divisional companies are able to offer over 90,000 jobs in future-proof industries.

RE:VIEWS: Talking about the future: what do you think are the biggest challenges at the moment and how can REMONDIS help master them?

Norbert Rethmann: Well, obviously climate change and the scarcity of natural resources. Our planet will soon be home to ten billion people and they will all want to have a good life and enjoy relative prosperity. Looking at the limited number of resources and the huge amount of energy this will require, this will only be possible with the help of the circular economy. All products must be designed so that all of their raw materials can be recovered and returned to production cycles for reuse. And, as far as technically possible, the energy needed to do this must come from renewable and sustainable sources.

Being one of the leading circular economy companies, we must not only come up with innovative technical solutions. Unlike many political organisations, we are obliged as an enterprise to actually take up and face the challenges of a circular economy. Just looking at SARIA, there are a whole number of opportunities to transform the separately collected materials into raw materials that can be used by the pharmaceutical industry. This means investing a lot of time and money in research, development and monitoring. And we’re not simply talking about doing all this. Our highly qualified staff are actually implementing them day in day out.

“Unlike many political organisations, we are obliged as an enterprise to actually take up and face the challenges of a circular economy.”

RE:VIEWS: Have you got any other concrete examples?

Norbert Rethmann: A whole number – but your magazine is not long enough for them all. I would, though, like to mention two more concrete examples. The first is the new industrial standard that we created a few years back when we developed the novel TetraPhos process that enables phosphorus to be recovered from municipal wastewater. The City of Hamburg already operates this system and other councils will follow as the legislator has made it obligatory for phosphorus to be recovered from 2029 onwards. The other is the new recycled product TSR40, a very recent example. The steel industry is one of the biggest carbon emitters and has set itself the goal of becoming climate neutral as soon as possible. The idea behind this is to produce steel using green hydrogen. At the moment, though, there is nowhere near enough green hydrogen available to do this that is affordable. The solution – and this is a solution that is also suitable for downstream industries that wish to grow the amount of recycled raw materials they use – is to use more high quality scrap steel in their production processes. For this to happen, there must be more products on the market like TSR40, i.e. products of a particularly high quality. We have built a state-of-the-art processing plant on our so-called ‘raw material island’ at Duisburg Harbour that is able to supply the steel industry with recycled metals that have a level of purity and quality that has never been reached before. Which means providing a sustainable supply of raw materials that has the least impact on the climate. And this is exactly what our company, which has now welcomed its fourth generation, stands for.

RE:VIEWS: Mr Rethmann, many thanks for taking the time to speak to us.

Image credits: image 1, 2: Adobe Stock: connectivisten; image 3, 4: © REMONDIS