1991 truly was a revolutionary year. This was the year that the Japanese electronics company Sony launched its Hi8 video camera CCD TR1. Those around at the time certainly did not put this moment down as something of global historical significance. With hindsight, though, it was an important milestone on the pathway towards a renewable energy system.

When the Japanese launched their CCD TR1, they also launched the very first battery that used lithium-ion technology. And it was this technology that allowed us to enjoy today’s mobile, digital lifestyle, that drove forward the electrification of an ever greater number of devices, sectors and spheres of life and that shaped the way the battery market has developed over many, many years.

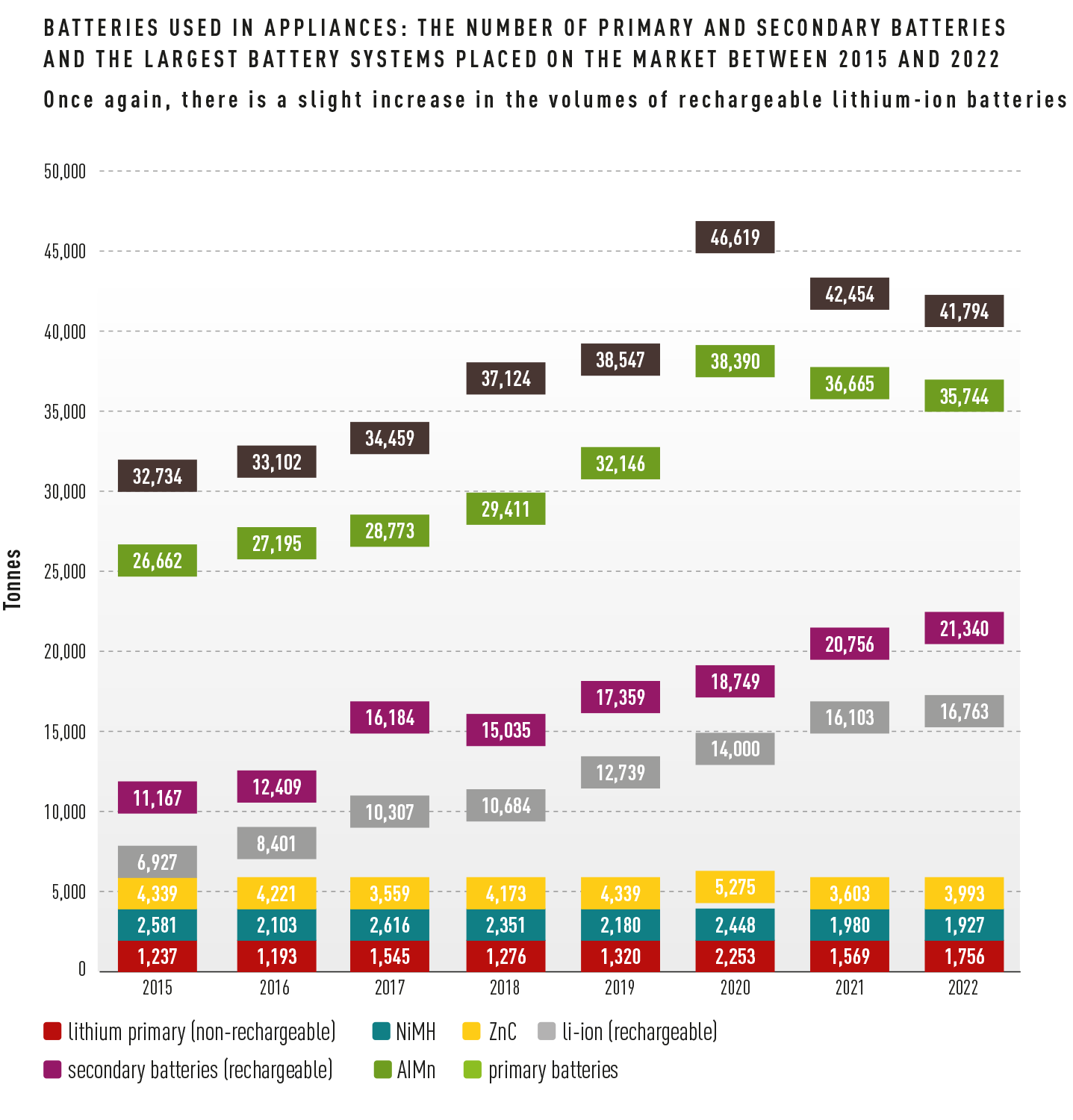

For a while now, experts have observed a stable trend away from single-use batteries – so-called ‘primary batteries’ – towards rechargeable secondary batteries. While it is true to say that primary batteries still make up the lion’s share of the market, figures published by the UBA [Federal Environment Agency] show that the number of primary batteries being placed on the market in Germany has been declining since 2020 and the number of rechargeable secondary batteries steadily increasing since 2018. The most common type of battery sold on the German market, though, is still the alkaline-manganese battery.

Nowadays, it is electricity that is primarily seen as being the key to achieving a green supply of energy. Compared to other forms of energy, it is easy to produce electricity with renewable systems and there are, in principle, no limits to the amount that can be generated thanks to the sun, wind and biomass. Electricity storage systems create a bridge between the volatile and unpredictable supply of renewable energy on the one hand and the demand for electricity from people and producers on the other.

Source: UBA

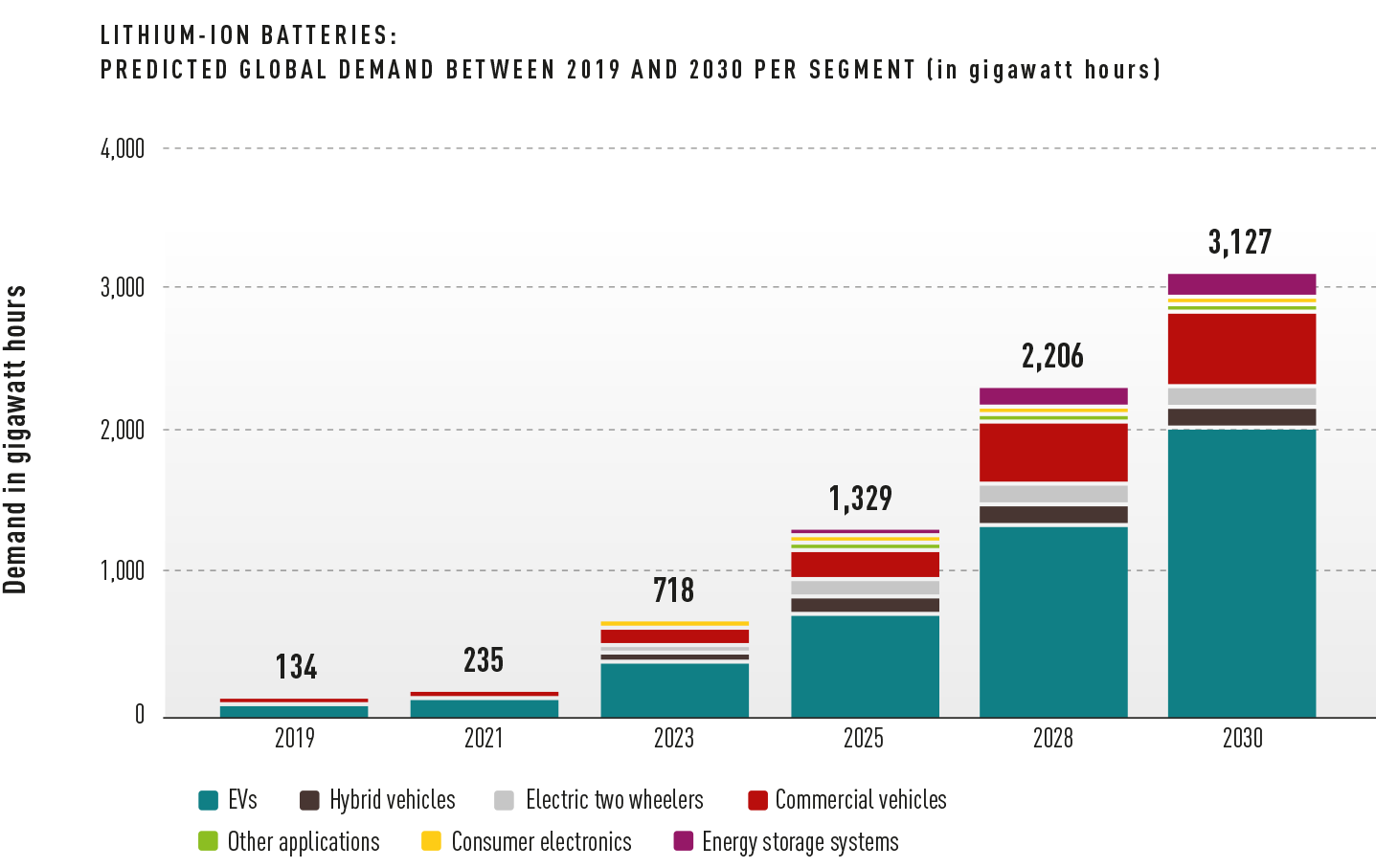

In its study ‘The lithium-ion (EV) battery market and supply chain’, the management consultancy firm, Roland Berger, predicts that global demand for lithium-ion batteries will have increased 23-fold by 2030 compared to 2019.

The electrification of the transport sector is changing the battery market

The changes being made to this energy system has had a direct impact on the battery market. The electrification of the transport sector has had a major impact on this market as this transition has pushed up the demand for rechargeable lithium-ion batteries. In its study ‘The lithium-ion (EV) battery market and supply chain’, the management consultancy firm, Roland Berger, predicts that global demand for lithium-ion batteries will have increased 23-fold by 2030 compared to 2019 – from a mere 134 gigawatt hours storage capacity to 3,127 gigawatt hours. The biggest driver behind this development will be electric vehicles (both cars and commercial vehicles).

Source: Roland Berger

No recycling … and the world may face a raw materials crisis

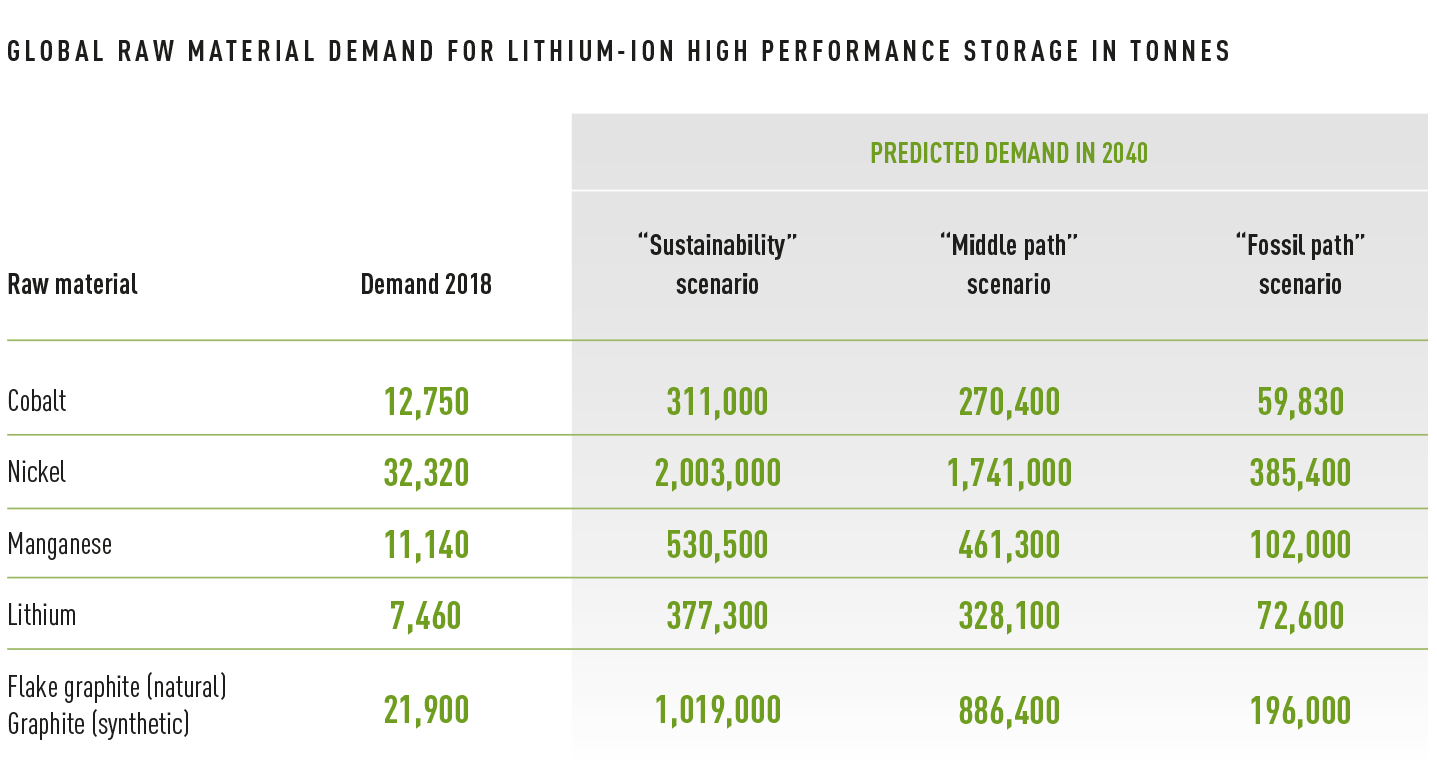

Batteries need raw materials and some of these are found in politically unstable regions or in countries led by autocrats. As the demand for high performance lithium-ion storage systems grows, so too will global demand increase for metals that enable lithium ions to cross over between the cathode and anode. While carrying out a study on behalf of DERA [German Mineral Resources Agency] in 2021, scientists at the Fraunhofer Institute for Systems and Innovation Research (ISI) in Karlsruhe predicted that global demand for raw materials such as cobalt, nickel, lithium and graphite will explode, even in a moderate sustainability scenario.

Source: DERA

Last year, Germany’s broadcaster Deutsche Welle quoted lithium expert Michael Schmidt from DERA, who said: “The current dynamics affecting the market are swamping it. I’ve not seen anything like it on the commodities market for the last 12 years”. These dynamics are having a dramatic impact on the environment – lithium mines alone have a really bad affect: according to Minviro (a company specialising in life cycle analyses), extracting one tonne of lithium hydroxide from hard rock generates around 15 tonnes of CO2 and consumes 170m³ of water and 464m² of surface area.

A circular economy approach must be set up for batteries if the energy transition’s environmental footprint is to be kept as small as possible. If this fails to happen, then the energy transition will lead to a raw materials crisis. Looking ahead, modern recycling technologies will enable up to 90% of lithium-ion batteries to be recycled.

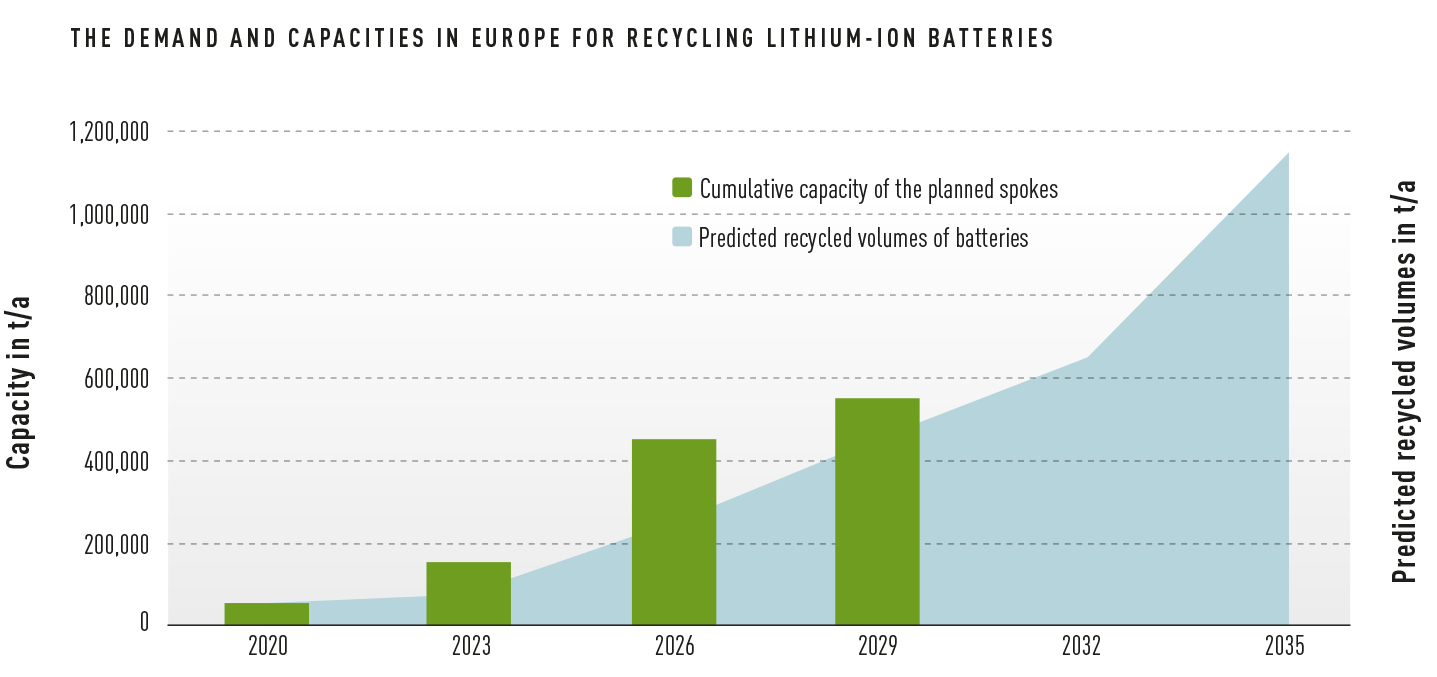

Recycling capacities in Europe will increase significantly over the coming years, in particular for lithium-ion batteries.

These capacities are, however, not yet available. It will, though, still be a while before the lithium-ion batteries currently being placed on the market reach the end of their service life. Market experts expect there to be a dynamic increase in the demand for battery recycling from 2027 onwards.

Both volumes and technology will drive forward the battery market

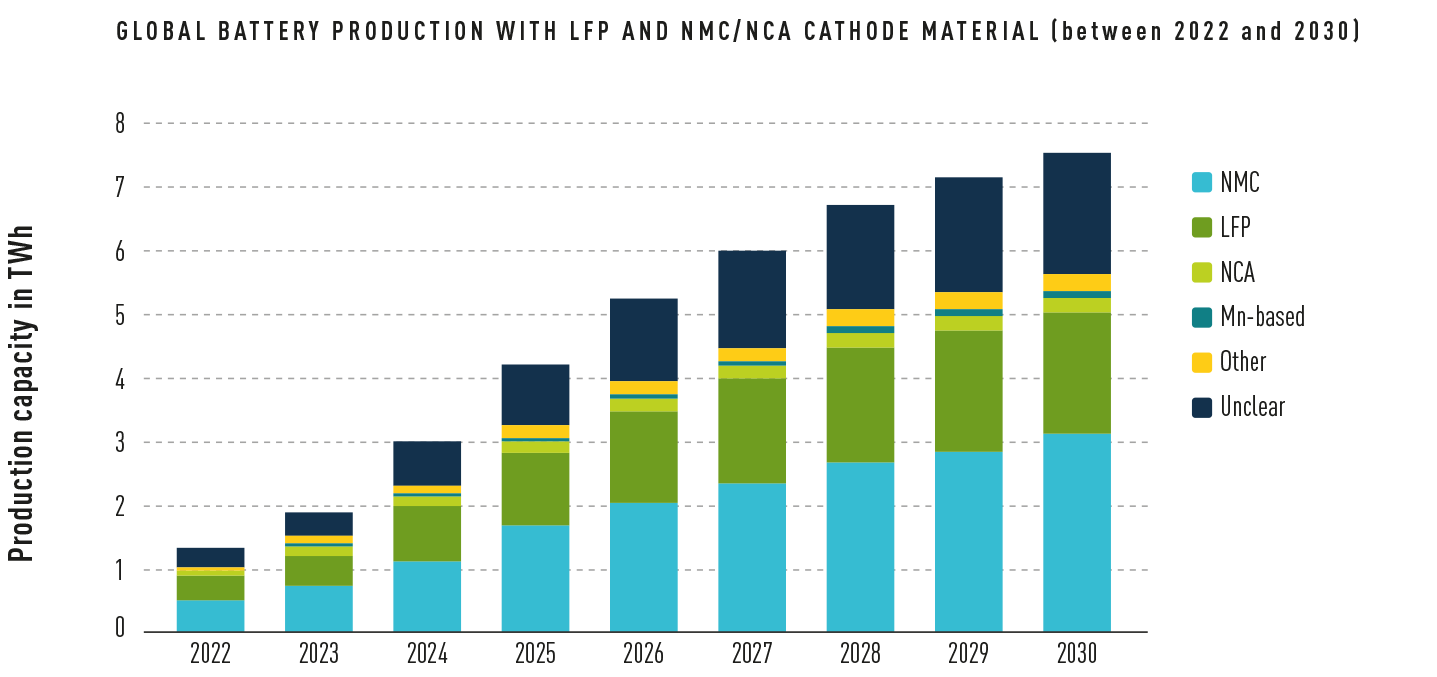

It is, however, not only the volumes of batteries that are creating the current dynamics on the battery market but the technology as well. A variety of lithium-ion batteries with different compositions of materials are available on the market at the moment. While, in most cases, the anode is made of graphite, the cathode materials can differ significantly. Chinese manufacturers, for example, primarily produce batteries with lithium and iron phosphate (LFP), whereas European companies tend to go for a nickel-manganese-cobalt (NMC) mixture.

LFP batteries are less expensive than their NMC counterparts as the cobalt used in the latter pushes up the price. On the other hand, NMC batteries have a greater energy density. Which means they can store more energy than LFP batteries. This is the reason why European car manufacturers prefer the NMC technology as it suits their high-price segment better. In all likelihood, the two technologies will exist side by side in the future as they serve different markets and market segments. It is also likely that other battery technologies will come onto the market.

Source: Fraunhofer ISI

For some years now, experts have been discussing the so-called solid-state batteries, i.e. the battery’s liquid electrolyte is replaced with a solid. One advantage of the solid is that it has a higher material density, which allows the battery to store more energy. This would give EVs a greater range. In an interview with the journal ‘Produktion’ last December, Timon Elliger, a research assistant at PEM (Battery Components & Recycling at Production Engineering of E-Mobility Components) at the University of Aachen, said that he believed solid-state batteries would probably only be used in the upper market segment as they are very expensive. They would not be playing a big role on the market over the next five years.

It would be a disaster for the current battery infrastructure if the market were to move towards solid-state batteries now. This would mean that the lithium-ion battery production plants that have been planned and built would become outdated before they had the time to amortise their investment. The reason for this is because the methods used to produce solid-state batteries and batteries with liquid electrolyte are very different.

Sodium-ion technology is particularly interesting because the key materials are considerably less expensive. What’s more, these batteries can be completely discharged without them being damaged.

Source: Fraunhofer ISI

Sodium-ion batteries, however, would not cause such a disruption. The principle of ions crossing over is the same as with lithium-ion batteries and the production process is also comparable to that used for the batteries currently on the market. A large part of the existing battery infrastructure could continue to be used.

Sodium-ion technology is particularly interesting because the key materials are considerably less expensive. What’s more, these batteries can be completely discharged without them being damaged. Lithium-ion batteries always need a minimum voltage, albeit a low one. If the voltage falls below a certain level (normally 2.6 V), then the battery’s copper film is destroyed and the battery can no longer be used. This means the whole question of logistics is much simpler with sodium-ion batteries. There is no danger of a fire breaking out when they are transported as they are completely discharged – and so such freight would no longer be classified as hazardous.

Experts, however, are assuming that sodium-ion batteries will complement the market rather than drive out their lithium-ion counterparts. The reason for this is because sodium-ion batteries have a much lower energy density than lithium batteries. Sodium-ion batteries have around just 60% of the storage capacity of modern NMC batteries. This technology is, therefore, primarily of use for smaller vehicles.

It is difficult to predict which direction the battery market will go in. The development depends on many factors, in particular the electrification of private transport. In all likelihood, several different technologies will exist side by side in order to best serve the market segments. Looking at the predicted demand, recycling is not only a useful option but an absolute must. If the batteries are not recycled, the energy transition will, sooner or later, lead to a raw materials crisis. The powerful dynamics of the battery market brought about by the technological developments, however, make it difficult for the recycling industry to plan ahead. The risk of making a bad investment is very high.

Looking at the predicted demand, recycling is not only a useful option but an absolute must…

You can find more articles on batteries here:

Image credits: image 1: Shutterstock: Smile Fight, Shutterstock: Chesky, Shutterstock: Artiste2d3d; image 2, 3: Shutterstock: Artiste2d3d