The climate committee, the Miljömålsberedningen, of the Riksdag (Swedish Parliament) has actually managed to negotiate its 860-page “Sweden’s Global Climate Footprint” plan with all eight political parties in the parliament so that all of them agreed to it – from the right-wing Sweden Democrats to the Left Party. Emma Nohrén, chair of the climate committee, handed over this substantial paper to the Swedish Minister for the Environment and Climate, Annika Strandhäll, during a press conference on 07 April 2022. It is now up to the Government to legislate the path towards this new and more ambitious target and to underpin it with robust accompanying measures. No other country in the world would then be able to match Sweden’s sustainability requirements.

So what is in Sweden’s new Climate Change Plan?

To begin with, the Climate Plan contains the previously set goal of reducing domestic emissions to net zero by 2045. The committee recommends adding two further goals here. The first covers the so-called ‘grey emissions’ that are generated by the Swedish population consuming foreign goods. According to the proposals put forward, these emissions should be reduced to net zero by 2045 as well. The second additional goal focuses on the so-called ‘climate benefits of exports’, i.e. the benefits that Swedish exports have over comparable products from other countries because they have a better climate footprint (such as more climate-friendly steel, forest products and electricity).

Sweden targets recycled raw materials

As a result, Sweden will also be setting totally new standards in its circular economy. Information about the materials used, product cycles, regional structures, transport routes and environmental technologies are all important for the country to free itself of the “grey” imported products and their high emissions.

Which is why it is targeting the delivery and procurement of raw materials. Besides introducing sustainability labels and product passports, its plans will mean the country will have to focus more and more on supplying itself with recycled raw materials. At the end of the day, Sweden is a big importer of goods. Around 60% of its greenhouse gas emissions can be attributed to the so-called “grey emissions” that were generated abroad.

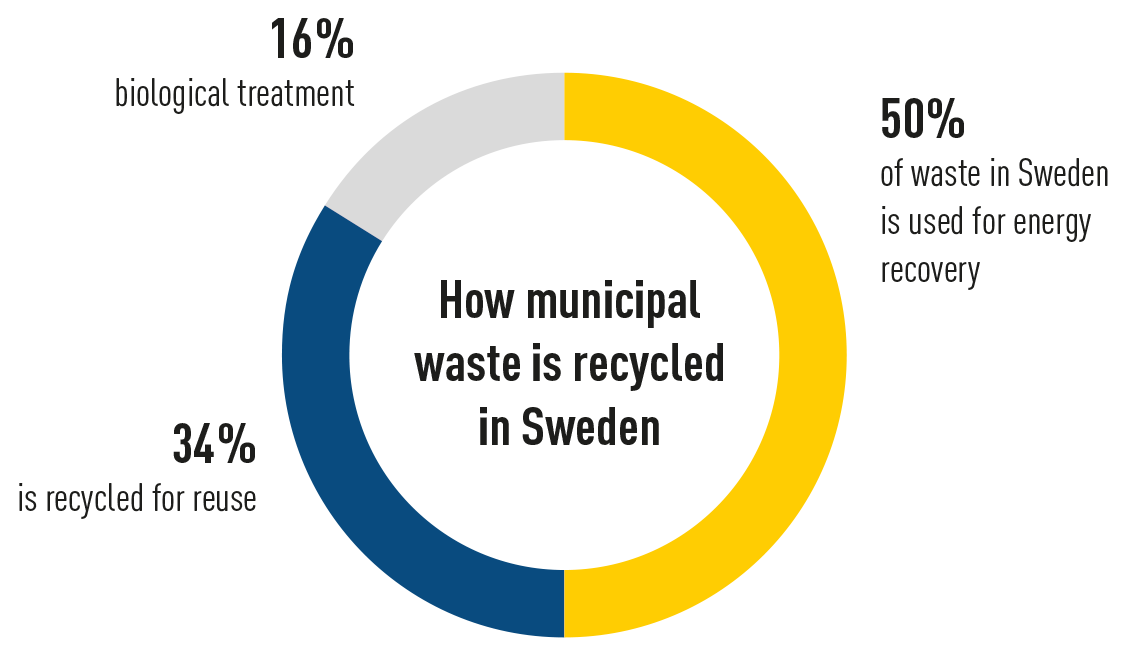

The problem: although sustainability plays a particularly important role in Sweden the country’s absolute recycling rates tend to lag behind those of the rest of Europe. Around half of all household waste in Sweden is used for energy recovery. Sweden’s seemingly endless forests gives it a natural locational advantage. The country has access to correspondingly high quantities of forest and wood waste, which makes up 42% of total volume. However, as the amount of waste generated is not enough for its waste-to energy plants to run to capacity, it must import additional volumes of material. For the most part, these come from the UK and Norway.

Things should change in favour of more recycling

The Swedish government’s plans include promoting recycling, banning the incineration of separately collected waste and introducing a waste incineration tax. This is based on the Government’s 2018 to 2023 Waste Management Strategy that provides for a reform of packaging, paper and food waste.

The general goal here is to steadily grow the recycling rates of recyclable materials by sorting waste better. In the future, therefore, separately collected waste streams may no longer be sent to waste-to-energy plants.

This will not be so easy for Sweden as the progress it has made in transitioning to clean energy is much more closely linked to the circular economy than is the case in other countries. If more volumes of sorted waste are recycled for reuse, then a key cornerstone of Sweden’s energy supply mix will be lost. And the country wishes all of its energy requirements to be covered by renewable, non-fossil sources by 2045. Nothing would then be standing in the way of it systematically expanding its local circular economy.

Better collections & more technology

According to the plan, households should have two further bins from 2024 onwards so that more waste can be sorted. Besides the separate bins that they already have for residual waste, paper, plastic & glass packaging, old paper, and e-waste, households should also be provided with bins for their old textiles and hazardous waste.

The country already has 580 collection centres (Atervinningscentral / AVC) for large volumes of waste and 5,800 unmanned collection points (Atervinningsstation / AVS) for old paper and packaging. Measures will be undertaken to extend the AVS network so that, by 2025, the system can be found in more residential areas and closer to local residents. The costs for doing this should not be covered by the councils but by the manufacturers by expanding ‘producer responsibility’.

At the same time, Sweden is specifically supporting start-ups in the circular economy. The ‘Cirkulära Affärsmodeller’ programme initiated by Tillväxtverket, the Swedish Agency for Economic and Regional Growth, not only offers seminars and workshops but also grants amounting to 58,000 euros to facilitate the purchase of technical systems for innovative circular business models.

Source: Branchenverband Avfall Sverige (2018)

What are grey emissions?

Greenhouse gas emissions are normally attributed to the country in which they are generated. This so-called territorial principle, therefore, also applies to the emissions of products that are to be exported to other countries. Countries with a high trade surplus, such as China, understandably feel disadvantaged by this. It makes sense, therefore, to consider the emission footprint of the imported products according to where they are consumed. It certainly makes a huge difference if greenhouse gas emissions are calculated according to the territorial principle or according to where they are consumed.

A perfect match

While people in Germany are green with envy at the political course Sweden’s government is taking to support the recycling sector, they, in turn, can provide help with their mature and well-engineered recycling infrastructure. State-of-the-art recycling technologies, closed material cycles and systems to recover raw materials from waste – leading recycling companies in Germany know all about the variety of collection, logistics and recycling options that are available for practically all kinds of material streams. And so it stands to reason that REMONDIS primarily sees the Swedish market as an opportunity to set new standards within the circular economy. Its recent takeover of approx. 21 business locations in the south west and north east of the country happened just at the right time – enabling it to accompany and actively support the country on its path towards becoming net zero.

REMONDIS in Sweden

The business locations that REMONDIS recently acquired in Sweden and that had been run by its competitor Veolia for four years originally belonged to the Hans Andersson company – a Swedish family-run recycling business steeped in tradition. The firm was founded by the brothers Herbert and Norbert Andersson in 1948 and primarily specialises in handling industrial waste. Veolia acquired the whole of the Hans Andersson Recycling Group AB on 01 September 2017. In 2022, REMONDIS then took over 21 business locations from the Group’s recycling division and 13 business locations from its industrial services division which were integrated into XERVON. REMONDIS now has a strong and experienced base in Sweden with its 400 new colleagues and fleet of over 530 vehicles. Being itself a family-run business, REMONDIS will be doing everything in its power to unite the Swedish and German cultures in the best possible way and to transfer the country’s progressive sustainability strategy into the circular economy.

Two questions for Ulf Ervér

Ulf Ervér was born in 1953 and has been working in the waste management and recycling sector since 1992. After graduating from the university of Göteborg, Ervér held a number of sales and marketing positions at large Swedish recycling firms. He has been at REMONDIS since 2017, lives in Göteborg and is a board member of the Swedish companies.

Ulf Ervér, you know both the markets in the north and in Germany really well. What are the special features of the Swedish and Scandinavian markets?

There has been considerable consolidation on the Swedish market over the last few years and many small, family-run businesses have been bought up by larger firms. Now that REMONDIS and Urbaser are established here, there are a handful of big companies leading the market.

Swedes see REMONDIS as being an innovative firm that enjoys steady growth. The market had been looking forward to seeing REMONDIS establish its business in Scandinavia. Environmental issues have been at the top of Sweden’s agenda for many years now. Corporate decisions are not only being shaped by economic factors but by environmental parameters as well. Recycling is a core topic here and Sweden is a world leader in some areas of the industry. Minimising the volume of traffic is important to many customers and the electrification of all types of vehicles is increasing. It is considered to be an advantage if a company has its own fleet and its own drivers – as REMONDIS does – as we then have control over the whole of the waste management chain.

The fact that we can deploy the new technologies and systems that REMONDIS has developed is a further key benefit as far as developing new fields of business is concerned. RETRON, the company’s battery management system, is an excellent example of this – in fact, we are in the process of launching it onto the Swedish market right now.

Are there any big differences between the way Swedes and Germans work? What should they take into account when they meet each other?

When it comes to business and leadership, the Swedes tend to have a more cautious and softer approach than Germans. Swedes often look to get a consensus of opinion so that absolutely everyone understands and is on board with the decisions that are made. Sometimes, when “German” decisions have been made, we say they should be “defused” and be widely supported before presenting them to the employees concerned.

A further important subject on the Swedish market is the ownership structure. REMONDIS has a big advantage here as the company is family owned and not in the hands of a financial investor. Such investors are seen as only being in the business for the short term and unlikely to want to invest in longterm projects. The situation is quite different at REMONDIS.

The managers of Swedish firms tend to be all-rounders rather than specialists in a particular area. Which is why Swedish companies delegate more than German ones. The detailed know-how and great commitment of the German partners are much appreciated here in Sweden – but they can also be a bit of a shock for the others taking part in the meeting.

Image credits: image 1, 3: Adobe Stock: by-studio; image 2: Adobe Stock: Alexander Gramlich; image 4: REMONDIS