There will be a sigh of relief just before Christmas when this issue of REMONDIS AKTUELL has been printed. It became clear during an editorial meeting at the beginning of October that the paper needed for the magazine should be ordered well in advance. The reason: a general shortage of raw materials. Paper is just one example here. Steel, aluminium, copper, plastics and semiconductors are also hard to get hold of at the moment. According to a survey carried out by the ifo Institute, 77.4% of German businesses said they were having difficulties procuring the primary products and raw materials they needed in September. Consumers may feel the consequences of this around Christmas time – be it a delay in supplies or higher prices. If we wish to reduce the dependency of local industry on imports and tackle climate change, then there really is only one solution: to use more recycled raw materials!

The covid pandemic has changed the way consumers behave. They are, for example, more likely to order the goods they need off the internet from the comfort of their armchair rather than go to the shops as they would have done in the past. And they have more money in the bank as the lockdown has meant they have been unable to go on holiday – money for a new car, for example. Wood for furniture, packaging material for online sales, and microchips, steel and aluminium for new cars. Raw materials that are normally in (almost) limitless supply. At the moment, however, raw material suppliers are finding it difficult to keep up with demand.

77.4% of German businesses said they were having difficulties procuring the primary products and raw materials they needed in September

Printers are running out of paper

As is the case with paper, as mentioned above. People who forget to take their own bags with them when they go shopping are often in for a nasty surprise. Many stores no longer have paper bags. The publishing industry is getting increasingly worried as well. Printers are finding themselves unable to print the number of copies they need as there is a lack of paper. According to the ifo survey in September, 79% are experiencing supply problems. Many paper manufacturers have been gradually cutting down on the amount of graphic paper they produce so that they can make more packaging material to keep up with the growing demand from online retailers. Graphic paper is needed for printing and copying – and for printing books. What’s more, the paper mills are themselves having difficulties accessing the raw materials they need: cellulose is essential for manufacturing paper and this has to be imported from Asia and South America. Supply chain disruptions, however, have meant that product deliveries have been delayed. The result: the price of cellulose has almost doubled within just a few months.

And then, on top of this, there is less old paper available on the market. Companies are printing fewer brochures and advertising materials. Fewer leaflets have been printed as hardly any events have been taking place. Newspapers are getting thinner. The volumes of old paper being generated have dropped, something that is particularly noticeable in the commercial sector. This, in turn, is having an impact on prices. Fastmarkets Foex recently reported that the price for old paper had increased by over 70% since the beginning of the year.

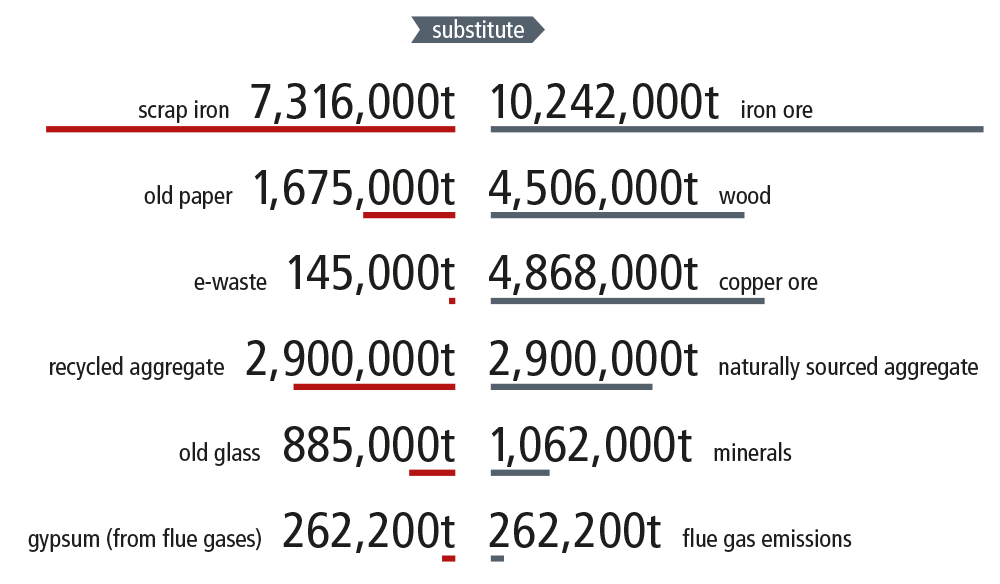

The table shows how REMONDIS’ recycling activities conserve natural raw materials (2016)

The car industry is being forced to slow down

The situation is just as serious in other industries: companies wishing to upgrade their fleet of vehicles need to be very patient. According to the ifo survey in September, practically all of the firms operating in the automobile industry (97%) were finding it difficult to get hold of primary products and raw materials. In some cases, they have had to shut down their production lines. Opel, for example, has closed its factory in Eisenach and will not be reopening it until the beginning of next year at the earliest. One of the challenges they face is procuring steel. Faced with the pandemic last year, many sectors like the automobile industry chose to cut back their production – something that led to a dramatic fall in the demand for steel. The response of the steelworks was to cut back their production as well and reduce their capacities. This has now led to supply bottlenecks and longer waiting times.

The automobile sector, however, is not just being affected by changing demand. The move towards electromobility and ever-smarter vehicle technology is also proving to be a challenge. Besides requiring conventional materials, they also need an ever-growing volume of new raw materials. The keyword here: microchips. According to PwC, the ongoing shortage of semiconductors alone will mean that eleven million fewer cars will be sold around the world this year.

And the next problem is just around the corner: WVMetalle (metals association) recently warned that there were supply bottlenecks for magnesium – a raw material needed to make aluminium. This could become a major issue: no other industry in Germany is as dependent on aluminium as the automotive sector. It consumes almost 50% of all the aluminium used in Germany. This material is found in a whole number of vehicle components and will become increasingly important as the automotive leightweighting discussions continue. A supply shortage could have a massive impact on car production.

According to PwC, the ongoing shortage of semiconductors alone will mean that eleven million fewer cars will be sold around the world this year

It is reckless for countries that have so few natural resources of their own, such as Germany, to be completely dependent on imported raw materials. We must begin to think in a circular fashion

A crisis impacting all sectors

Practically every sector has been affected by the raw material crisis. This was highlighted in a survey carried out by the German Association of Chambers of Industry and Commerce (DIHK) in August 2021: of the approx. 3,000 German companies located in Germany and abroad that took part, 83% (across all industries) stated that they were facing rising prices and/or problems procuring raw materials, primary products and goods. Just 20% were expecting the situation to have eased by the end of the year. 53% believe things will not begin to improve until 2022.

And yet, this should not come as a surprise as we have known for a long while now that the world’s supply of raw materials is finite. The UN has forecast that up to 10 billion people could be living on our planet in 2050. At the same time, the global middle class is growing which, in turn, is leading to an exponential growth in the pro capita consumption of raw materials. Humanity, though, is already taking more than its fair share. Earth Overshoot Day – the day when the demand for natural resources in a given year exceeds what Earth can regenerate in that year – was on 29 July this year. Humans are already consuming the resources of 1.7 planet Earths. A figure that continues to rise.

Despite these numbers, the Circularity Gap Report reveals that the global economy extracts more than 100 billion tonnes of virgin raw materials from the ground every year using energy-intensive processes. These raw materials are processed, consumed and disposed of or incinerated – creating a linear system. This system, however, becomes a stumbling block when there are global shortages. Companies must accept rising prices if they wish to procure the raw materials they urgently need. Industries that shoulder a nation’s prosperity find themselves on the brink of collapse.

Thinking circular

It is reckless for countries that have so few natural resources of their own, such as Germany, to be completely dependent on imported raw materials. We must begin to think in a circular fashion. According to BCG, a firm of consultants, if Germany were to invest between 50 and 60 billion euros it could reach a total circularity of up to 75% for many different materials by 2040. A lot of money but a move that would certainly be effective. Transitioning to a circular economy can underpin the competitive position of companies and create new jobs. Recycled raw materials, therefore, must no longer be seen as the number two choice – either from a technical or from a business point of view.

And when it comes to tackling climate change, they are a better choice than virgin raw materials. According to statistics published by the Ellen MacArthur Foundation, the circular economy has the potential to cut CO2 consumption by 45%. Steps have already been taken in a variety of material flows to ensure that the circular economy has a long-term positive impact on global warming. REMONDIS already produces over 30 million tonnes of recyclates that are then supplied to industry as new raw materials. With its diverse innovations and patents, it is helping to safeguard raw materials and, consequently, to curb climate change.

Raw material security and climate action go hand in hand: the circular economy has the potential to cut CO2 consumption by 45%

Paper recycling – an alternative to deforestation

Across the world, forests play a vital role producing oxygen and absorbing greenhouse gases. Which is why, over the long term, it is not sustainable for every one in five trees felled to be used to produce virgin fibre paper. REMONDIS is leading by example here: every year, it collects and processes 2.2 million tonnes of old paper so that around eight million tonnes of forest wood no longer need to be cut down.

In its eleven sorting plants across Germany, the company first separates the different kinds of old paper according to type before packing them up. Sorting them is particularly important, especially when you consider the transition mentioned earlier – i.e. the move from graphic paper to packaging material. The increasing volumes of mixed packaging has meant that the composition of the recyclable materials has changed and this is creating new challenges for recyclers. REMONDIS Trade and Sales has responded to these challenges by investing in even better quality management processes. These should ensure that the quality of the secondary raw materials that it sends to its customers in the paper industry remains at a consistently high level.

The publishing industry is getting increasingly worried as well. Printers are finding themselves unable to print the number of copies they need as there is a lack of paper

Green steel from high quality scrap steel

Changing the way steel is produced – one of the most energy-intensive industries around – could also significantly cut carbon emissions. Here in Germany, discussions are focusing, for the most part, on green steel, i.e. steel that is produced with preferably no CO2 emitted either during the smelting or the processing stages. To be able to achieve this, companies must stop using coal and coke as their source of energy and as a reducing agent in their smelting processes. The idea here is to use ‘green hydrogen’ as a climate-neutral substitute. The problem: where to get hold of such large volumes of green hydrogen and who should pay for it?

Changing the way steel is produced could also significantly cut carbon emissions.

And yet green steel has been around for ages – namely, steel produced from high quality scrap steel. This material is sourced from discarded products that contain a large amount of steel, such as household appliances and cars. There is a huge potential here as this metal can be fully recycled. Scrap steel is already being used for cooling in production processes. Thanks to this system, the raw materials can be recovered and reused. At the moment, however, the extent to which steel scrap can be used to produce high quality primary steel is limited – in particular because of its heterogeneous composition.

In response to this situation, TSR Recycling is currently developing a new procedure that aims to increase the amount of recycled material used in steel production processes. Consumer scrap is to be used here to make a high quality product, whose properties can be precisely determined. The challenge faced by the company is to find a way to separate and remove any unwanted materials from the iron so that the product can be certified as a raw material suitable for smelting furnaces.

This system is to be tested and optimised in a joint project so the material can be used in thyssenkrupp Steel’s furnaces. Using this product will lead to a reduced use of pulverised coal injection and a lower consumption of coke in both the furnace and the converter: CO2 will be cut by around 1 tonne every time a tonne of recycled material is used in the furnace. And in the converter, one tonne of recycled material used will lead to CO2 savings of 1.7 tonnes. Numbers that underline how this strong collaboration is further strengthening the circular economy.

REMONDIS is leading by example here: every year, it collects and processes 2.2 million tonnes of old paper so that around 8 million tonnes of forest wood no longer need to be cut down

Increasing recycling rates

It is clear that recycling rates must be increased for all materials. The world’s population is increasing and the planet’s natural resources are decreasing – the maths is simple.

There is one thing though that is often forgotten: recycling is not simply something to be considered at the end of a process. Ultimately, a product can only be fully recycled if the materials used to make it can be separated from each other when it reaches the end of its useful life. If all raw materials are to become circular in the future then regulations must be introduced regarding the ecodesign of products and packaging, i.e. ‘Design for Recycling’.

Moreover, the path towards creating a circular economy also presupposes that the recycled raw materials will be reused in production processes. This will only happen if governments introduce minimum content mandates. Currently, recycled raw materials make up around 14% of the raw materials consumed by German industry. Doubling this share to 30% would cut carbon emissions by an additional 60 million tonnes. A price should also be charged on the carbon emissions emitted along the supply chain from the raw product to the final product. It must be worth a company’s while to use carbon-saving recycled raw materials.

There is another item high up on our wish list besides paper, semiconductors, steel and other raw materials: that we all – producers, politicians and consumers – work together to create a successful circular economy. An ambitious appeal but one that is extremely urgent in light of the raw material crisis.

Image credits: image 1: Adobe Stock: Zffoto; image 2: Adobe Stock: DigitalGenetics; Adobe Stock: SZ-Designs; image 3: Adobe Stock: Kerim; Adobe Stock: SasinParaksa; image 4: Adobe Stock: imaginando; Adobe Stock: Ievgen Skrypko