The European Union’s package of measures is as ambitious as its title implies and should call to mind the New Deal in the USA. And the name ‘New Deal’ says it all: the goal in both cases was and is to reshuffle the cards. In the 1930s, US President Franklin D. Roosevelt was looking to stabilise the US economy and readjust the equilibrium between companies and their workforces. Today, EU Commission President Ursula von der Leyen’s aim is for billions to be invested in climate action measures to balance out the interests of the climate, prosperity and growth. And so EU member states must reduce their greenhouse gas emissions by at least 55% (compared to 1990 levels) by 2030. It is by no means certain, however, that this target will be reached. According to the German government’s 2021 Climate Action Report, for example, Germany – Europe’s largest economy – missed its self-imposed milestones in a number of areas.

Various fields of action

The European Union announced its Green Deal in 2019 as its central project to achieve the global climate goals set out in the 2015 Paris Agreement. Presented in July 2021, ‘Fit for 55’ was the EU Commission’s first package of measures. The member states, Commission and Parliament agreed on this package’s main content at the end of 2022, although some of it must still be approved by EU committees. What is particularly remarkable has been the determination of Europeans to stick to this path. Brussels has continued to push forward measures despite the Covid pandemic and despite Russia’s invasion of Ukraine – clear proof of just how seriously climate change is being taken. More seriously than in Germany.

The Green Deal Industrial Plan was then added to the overall package in February 2023. This investment programme is the response to the subsidy plans that the USA announced in the summer of 2022 and that Europe fears may lead to industrial and technology firms relocating to the US. Two primary goals of the Green Deal Industrial Plan are to make it easier for funds to be accessed for clean production as well as for innovations in this area.

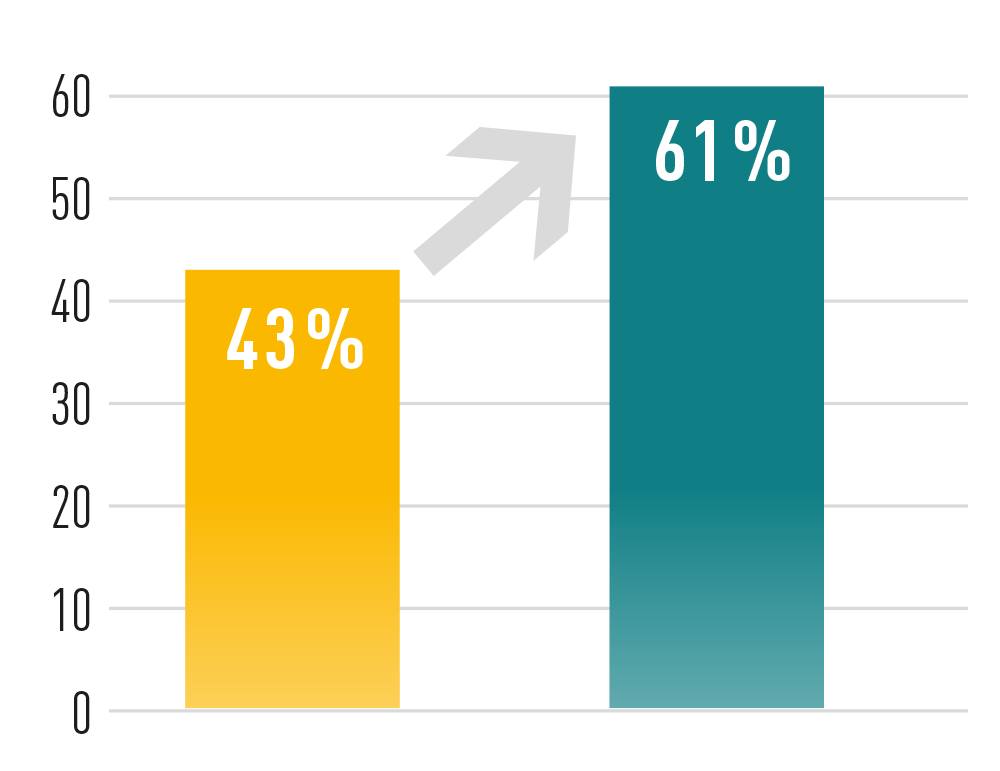

The first field of action included in ‘Fit for 55’ is to tighten up the EU’s climate goal of reducing EU carbon emissions. The 2030 emissions reduction goal in the EU’s emissions trading system (ETS) has been increased from 43% to 61%. Furthermore, this trading scheme has been extended to include maritime transport and a second ETS is to be set up for transport and buildings.

The carbon border adjustment mechanism (CBAM) is also to be introduced to ensure that the additional burden caused by the emissions trading system does not put companies located in the EU at a disadvantage. This mechanism aims to make sure that firms importing goods from non-EU countries must adhere to the same environmental standards as European businesses.

Secondly, the EU presented its ‘RepowerEU’ plan in order to make progress in the area of energy generation. This plan sets out more ambitious targets to drive forward the share of renewables in the EU. The revised version of its Renewable Energy Directive also includes industry-specific targets for sectors such as transport and buildings as well as district heating and cooling systems.

And thirdly, the spotlight is also being turned on the energy performance of buildings, something that had long been put on the back burner because of the financial impact it will have on home owners and tenants. The measures here include introducing minimum energy performance standards for buildings and providing financial help to encourage renovations to make older buildings more energy efficient.

The 2030 emissions reduction goal in the EU’s emissions trading system (ETS) has been increased from 43% to 61%

The German economy is struggling

With so many different fields of action, it is above all companies that find themselves facing some major challenges. At the end of the day, their goal must be not only to adjust their business models but also to ensure that such adjustments do not lead to a deindustrialisation of Europe and to sweeping job losses. Despite these challenges, German businesses see the transition to a green economy as being more of an opportunity than a risk. According to the KfW’s Climate Barometer published in March 2023, around 44% of all large companies expect the transition of the German economy towards climate neutrality to have a positive impact on their own international competitiveness. A further 31% are assuming that the green transition will not affect their competitiveness. Just 16% of the firms believe it will have a negative effect. This survey involved companies that have an annual turnover of over 500 million euros.

The situation in the German economy, though, is more complex and this can be seen in the latest figures from the University of Stuttgart’s Institute for Energy Efficiency in Production (EEP). For the last ten years now, the institute’s experts have been taking the pulse of German firms every six months to assess energy efficiency developments, one of the key elements for transitioning to net zero carbon. Their latest figures for the second half of 2022 reveal a historically low willingness to invest in this area; a trend that has been noticeable since the beginning of 2021. “The reasons for this would appear to be the pandemic and the energy emergency,” explained Alexander Sauer, director of the EEP. “The high energy prices and the insecurities caused by this are obviously creating a reluctance to commit to new investments and this is reflected in a low investment index.”

The goal is for EU member states to reduce their greenhouse gas emissions by at least 55% (compared to 1990 levels) by 2030.

Cutting emissions intelligently

This trend has also been confirmed by the experts at Germany’s largest independent energy consulting firm, ECG Energie Consulting. According to Wolfgang Hahn, a managing partner at ECG, Germany’s businesses have been struggling to commit to long-term investments since the beginning of the pandemic and, even more so, since Russia’s invasion of Ukraine unless they were obliged to do so by law. Generally, they are more focused on achieving abstract savings targets, i.e. on choosing the most economically robust options and then implementing them sensibly over a number of years.

It is becoming far more complex for companies to assess the cost-effectiveness of investments as they face fragile supply chains, an at-risk customer base and a volatile energy market. Hahn referred to the climate plans of the EU and the German government, saying: “The toughening-up of the emission reduction targets is a reality that a cost-aware and responsible business cannot simply ignore.” Having said that though, he stressed that this requires investments that have been well thought out and well calculated.

For the most part, companies are focusing on four main areas to cut their carbon emissions. Firstly, they are looking at switching to alternative sources of energy to run their production operations, for example switching from gas to electricity. These projects tended to be shelved in the past as such switchovers were either not sufficiently cost effective or involved complex technological challenges. With the framework conditions faced by firms having changed so substantially, however, many believe the time has come to finally do this.

Secondly, steps are currently being taken – if only for cost reasons – to reduce levels of energy consumption. Over the last ten years, the introduction of a number of useful measures (e.g. energy audits, energy management systems and carbon footprint calculation tools) has highlighted areas where companies can cut their energy consumption; lighting, ventilation and compressed air systems are just three common examples.

Businesses that have not gathered such data in the past have now begun doing so. This data is key to be able to actually measure how successful they are at cutting consumption and to identify which parts of their operations are their most energy intensive. Companies across Germany are working hard on this at the moment.

And the same is true for the subject of waste heat – something that, for many years, has been the ‘poor relation’ when it comes to decarbonisation. Capturing waste heat so that it can be used in production processes has not always been a financially or technically viable option. What’s more, there has often been a lack of ideas about how exactly the energy generated by the waste heat can be put to good use. Despite this, many companies are sitting on a treasure chest that just needs to be opened up.

Fourthly, firms are thinking seriously about how they can generate their own green electricity. Solar panels enable them to at least cover their minimum requirements and, if storage batteries are installed, they can be less dependent on the electricity market and have their own source of electricity that is not tied to market prices. These require a lot of planning, permits have to be applied for and considerable sums of money have to be invested. In many cases, though, the cost effectiveness of such projects are obvious. The fact that such a step can be used by firms to improve their image and present themselves as a sustainable business also plays a major role here.

And so there is much for Germany’s companies to do. But that’s not all: having passed the ‘EnSimiMaV’ [Ordinance on Securing Energy Supply through Medium-term Impact Measures], the legislator has made it obligatory for companies to introduce energy-saving measures into their businesses and set out exact specifications about how cost efficiency should be calculated. Shelving a project because of costs is no longer an option. The message is clear: Germany’s firms must help the country reach its climate targets. And the good news here is that the majority of the businesses believe that they will benefit from this in the end as well.

“Europe can only be climate neutral if it has a strong circular economy”

It was inevitable: the circular economy has also been included in the ‘Fit for 55’ package as recycling is an indispensable cornerstone of a sustainable, climate-friendly economy. This package contains measures covering production, consumption, waste management, the development of a market for recycled raw materials, food waste, innovation and investments as well as the monitoring of the circular economy. Herwart Wilms, managing director at REMONDIS, vice president of the BDE [Federal Association of the German Waste Management Industry] and recently appointed vice president of FEAD [European Waste Management Association] and chair of the committee for raw material policies at the BDI [Federation of German Industries], believes that ‘Fit for 55’ will help drive the sector forward. In a recent interview he discussed how the circular economy is intending to reduce its carbon emissions and what tools it can provide to other industries to help them transition to net zero.

RE:VIEWS: Mr Wilms, which measures in the ‘Fit for 55’ package do you believe will have the biggest impact on the future of the German economy?

Herwart Wilms: The most important measures will certainly be those taken to reform the emissions trading system. The ‘Fit for 55’ package has extended this system and more sectors must now buy ‘allowances’ if they continue to emit greenhouse gases. The steadily increasing price for these allowances will soon mean that the only business models that will be competitive will be those that emit very few or no emissions.

RE:VIEWS: And how will this affect the waste management and recycling sectors?

Herwart Wilms: We had hoped that the thermal treatment of waste would also be included in the EU emissions trading system but it wasn’t put on the list. The Commission is planning to take a closer look at this and possibly revise their decision in 2028. An opportunity was missed here to introduce both a climate action measure and competitiveness across Europe as well as to take a comprehensive view of waste management – from landfilling, which unfortunately still exists, to incineration, all the way through to materials recycling. In contrast, Germany will be including thermal treatment in its national emissions trading system from 2024 onwards. We believe, though, that it is wrong for countries to go it alone.

Herwart Wilms, Managing Director at REMONDIS

RE:VIEWS: What will that mean then if Germany and the European Union develop their emissions trading systems at a different pace?

Herwart Wilms: If the costs in Germany are higher than those in the other European countries, then this will create an incentive for businesses to send volumes of materials abroad, especially to the neighbouring regions. Transporting this waste generates further carbon emissions and incinerating it abroad emits the same amount of CO2 as would be emitted in Germany – just cheaper and with no additional levies. This, of course, makes absolutely no sense as far as curbing climate change is concerned!

RE:VIEWS: So Germany is ahead of the European Union when it comes to its emission trading system. Are there any other circular economy laws where this is also the case?

Herwart Wilms: No, not at all. The Green Deal has set a whole number of things in motion at EU level and the EU is currently pressing ahead with many different measures, which it hopes will help drive forward the circular economy. Europe can only be climate neutral if it has a strong circular economy and so the Circular Economy Action Plan is one of the most important pillars of the Green Deal.

RE:VIEWS: Which measures in particular are currently being advanced at EU level then?

Herwart Wilms: One of the most recent measures is the proposal for a Critical Raw Materials Act. The war in Ukraine has once again highlighted how dependent we are on raw materials here in the EU. The increasing volumes of materials being extracted from the ground, though, is also a big problem for our climate. The mining and processing of virgin raw materials are responsible for 90% of biodiversity loss. Which is why there are some ambitious recycling targets for critical raw materials in this proposal.

RE:VIEWS: Do you think that these obligatory recycling rates will be the most effective lever to genuinely increase the volumes of recycled materials?

Herwart Wilms: They’re definitely an important lever but they’re not the only one. If the volumes of recycled materials are to increase, then products must first be designed so that their contents can be separated from each other again and processed – i.e. the whole issue of ‘design for recycling’. And the recycled raw materials need to find their way back into production cycles. The only truly relevant recycling rate is the one that states what share recycled raw materials make up of all the raw materials used in production. At the moment, this currently lies at a modest 13%.

RE:VIEWS: Are measures being planned to tackle these issues?

Herwart Wilms: The EU is currently working on its sustainable product initiative to revise the Ecodesign Directive. The goal here is to set product design requirements regarding the use of recycled raw materials in products and the recyclability of products. By introducing digital product passports containing specific information about the product, it will also become easier to choose the best way to recycle it. What’s more, the EU is also planning to introduce a label.

The mining and processing of virgin raw materials are responsible for 90% of biodiversity loss.

RE:VIEWS: And what information will be shown on this label?

Herwart Wilms: It should show how recyclable a product is and whether recycled raw materials were used to make it. I’d prefer the labels to have a traffic light system with green being used for products that are particularly suitable for recycling.

RE:VIEWS: So that consumers can see straight away whether they’re buying a sustainable product?

Herwart Wilms: Exactly! At the moment, many people would really like to shop sustainably but there are very few ways for them to find out about the recyclability of a product. Such a label is an easy way for consumers to get the information they need.

RE:VIEWS: This wish to shop sustainably will certainly have a big impact on the market.

Herwart Wilms: Yes, I’m sure it will. We mustn’t forget the public sector either. Local authorities are already obliged to act sustainably when they buy the products they need. At the moment, however, they don’t have an objective criterion that they can use to prove they are being sustainable and legally compliant. And as long as they don’t have such a criterion, those in the public sector in charge of procurement will continue to focus more on cost effectiveness and on saving money and choose the cheapest product. If they’re only allowed to buy products from the green category in the future, then this will have a huge impact on the market. At the end of the day, the public sector in Germany alone spends 500 billion euros a year.

RE:VIEWS: Mr Wilms, many thanks for this really interesting discussion.

“Our sector needs to master the challenge of reducing our carbon emissions and, at the same time, provide other industries with recycled raw materials and optimum recycling systems as both are essential tools for them as they head towards becoming net zero.”

Herwart Wilms, Managing Director at REMONDIS

Image credits: image 1: Adobe Stock: dell, Adobe Stock: industrieblick, Adobe Stock: Denis Rozhnovsky, Adobe Stock: waldemarus, Adobe Stock: DerL, Adobe Stock: Krit, Adobe Stock: mvdesign; image 2: Adobe Stock: Krit, Adobe Stock: Federico Rostagno, Adobe Stock: bluedesign, Adobe Stock: chrupka, Adobe Stock: chekart, Adobe Stock: kinwun, Adobe Stock: Siwakorn1933; image 3: © REMONDIS; image 4: Adobe Stock: chekart; image 5: Adobe Stock: Krit